Total Annual Gross Income Student

Collects an earnings supplement of 12130 per year 37000 minus 12740 divided by 2 f or a total gross income of. Information about income and financial support Childcare grant and parent learner allowance Parents pension Household income and whether pension contributions are included.

It is important to note however that these figures have not.

Total annual gross income student. De très nombreux exemples de phrases traduites contenant total gross annual income Dictionnaire français-anglais et moteur de recherche de traductions françaises. Your household income includes any of the following that apply. Any money that must be repaid should not be counted as income.

Your gross income minus taxes and other expenses like a 401k contribution. That comes down to how much disposable income you have after paying for necessities like rent. Theres no law against including student loan disbursements in your total annual income.

Its important to know the difference between the two because you use net income. If it asks for monthly income multiply your weekly amount by 52 and then divide by 12. You can also count the amount of income you anticipate you will make from the job.

10000 20000 30000 40000 50000 60000 70000 80000. Itll probably appraise for 180000 or so. But student loan money shouldnt be counted as income on a credit card application because its not incomeits debt.

You cant get a Student Allowance if their joint earnings while you study are more than. I have about 3000 in credit card debt and a 15000 personal loan which I used to buy my car and consolidate some old debt. Unless the application specifies otherwise this is usually what the issuer is looking for.

Student loan pension contributions bonuses company car dividends Scottish tax and many more advanced features available in our tax calculator below. Data on the total annual gross income of British Medical Association BMA in the United Kingdom UK from 199900 to 201819 shows that at the start of this period gross income was over 63 million British pounds. My mortgage is 800.

That counts as gross income. Your total annual income before anythings taken out. For example someone with a gross annual income of 100000 and a tax rate of 25 would have a net annual income of 75000.

I purchased the house for 135000 and owe 90000 on it. The majority of working college students earn between 7500 and 42000 per year. This disposable income could be as little as 100 or it could be more.

Annual gross income or AGI is sometimes confused with net annual income. Its all your income from all sources before allowable. Your gross annual income.

If your credit card application asks for your annual income and youre paid weekly multiply your weekly amount by 52. The combined income of one of your. In other words what you end up taking home in your paycheck multiplied by the number of times youre paid each year.

20000 in student loans which are in COVID forbearance. If your annual salary is 48000 your gross monthly income would be 48000. As long as you dont grossly exaggerate your income.

Those are gross income as well. Data on the total annual gross income of the General Municipal Boilermakers and Allied Trade Union GMB in the United Kingdom UK from 199900 to 201819 shows that at the start of this period gross income was over 46 million British pounds. They dont expect an exact answer down to the dollar or even down to the thousand dollar range.

9979243 if you live with them. The payment is 300 per month. They are trying to figure out how much credit they can give you and reasonably expect to have repaid.

Gross income is the starting point from which the Internal Revenue Service IRS calculates an individuals tax liability. Your gross annual income is the amount you earn before any deductions such as income tax withholding employee benefit costs or retirement plan contributions are deducted from your pay. In total from 199900 to 201819 BMAs gross annual income grew by approximately 75 million British pounds.

Many translated example sentences containing total gross annual income French-English dictionary and search engine for French translations. In total from 199900 to 201819 GMBs gross annual income grew by approximately 29 million British pounds during this time period peaking in. Gross annual income refers to all earnings Earnings Before Tax EBT Earnings before tax or pre-tax income is the last subtotal found in the income statement.

While AGI is the amount of money you receive in a fiscal year your net annual income is the amount left after taking deductions into account. 10759998 if you dont live with them. Your parents income if youre under 25 and live with them or depend on them financially.

If your parents joint earnings are more than 5754528 a year before tax the rate you get for Student Allowance goes down. Many students use loan money for personal expenses while in school but that doesnt mean its income. Annual income is the total value of income earned during a fiscal year Fiscal Year FY A fiscal year FY is a 12-month or 52-week period of time used by governments and businesses for accounting purposes to formulate annual.

Student Finance ACCOUNTING HELP - Balance sheet and Income Statement Divorced parents. Also pay attention to whether the issuer wants gross before taxes or net income. Therefore for example a participant in British Columbia who works 35 hours per week at 7 per hour earns 12740 per year and.

Calculate your net salary and find out exactly how much tax and national insurance you should pay to HMRC based on your income.

How Much Do Tertiary Students Pay And What Public Support Do They Receive Education At A Glance 2019 Oecd Indicators Oecd Ilibrary

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

How Much Do Tertiary Students Pay And What Public Support Do They Receive Education At A Glance 2019 Oecd Indicators Oecd Ilibrary

How Much Do Tertiary Students Pay And What Public Support Do They Receive Education At A Glance 2019 Oecd Indicators Oecd Ilibrary

Your Discretionary Income Student Loans How One Impacts The Other Student Loan Hero

How Much Do Tertiary Students Pay And What Public Support Do They Receive Education At A Glance 2019 Oecd Indicators Oecd Ilibrary

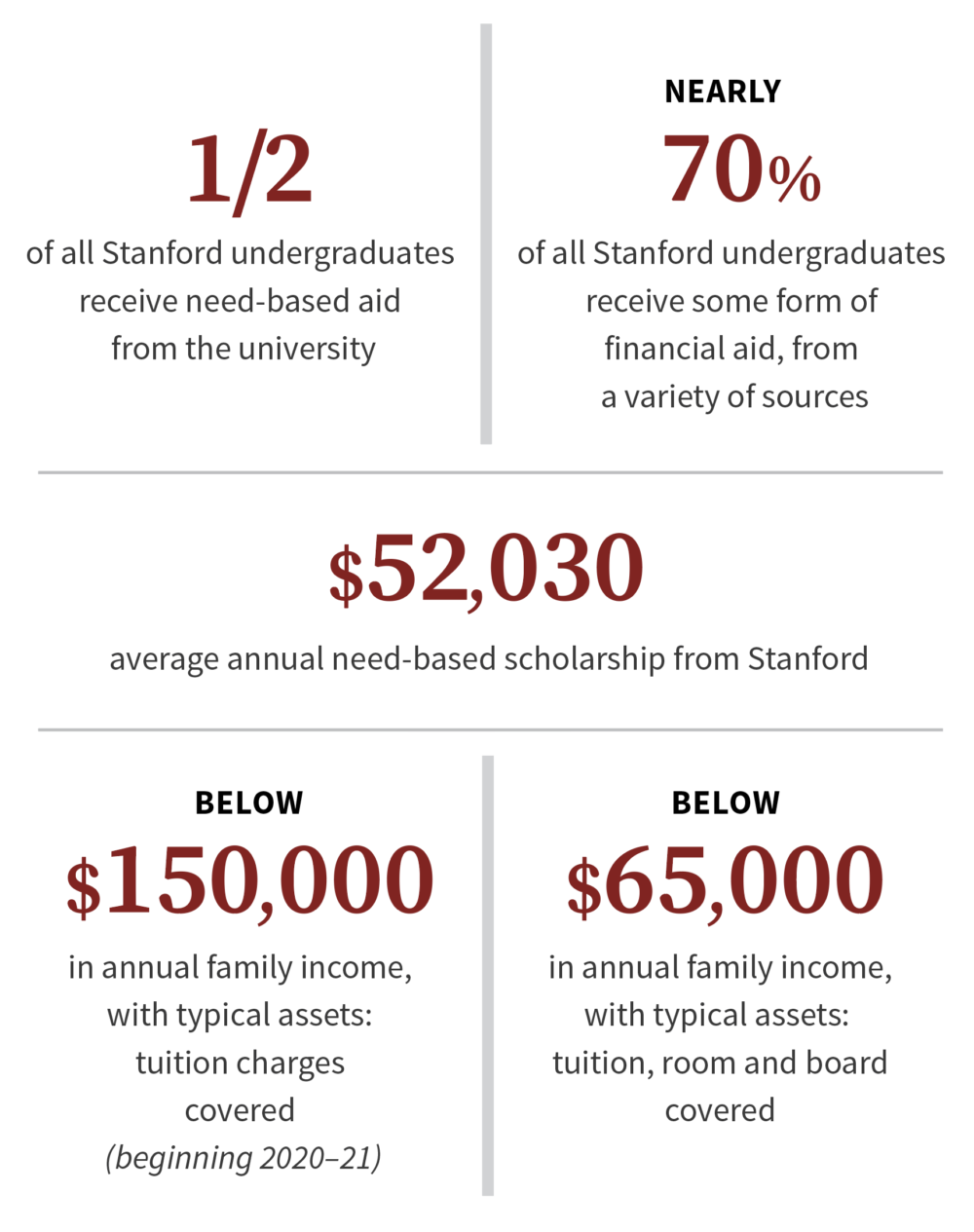

Trustees Set 2020 21 Tuition Again Expand Financial Aid For Middle Income Families Stanford News

15 Faqs Annual Income On Credit Card Applications 2021

How Much Do Tertiary Students Pay And What Public Support Do They Receive Education At A Glance 2019 Oecd Indicators Oecd Ilibrary

How Do Gross Profit And Gross Margin Differ

The Pell Grant Proxy A Ubiquitous But Flawed Measure Of Low Income Student Enrollment

Student Loan Deductions Moneysoft

Income Based Repayment Calculator Ibr Save On Payments

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Annual Income Learn How To Calculate Total Annual Income

21 000 After Tax 2021 Income Tax Uk

Student Loan Debt Statistics 2021 Average Total Debt

Student Loan Debt Statistics 2021 Average Total Debt

Post a Comment for "Total Annual Gross Income Student"