Net Income Meaning For Dummies

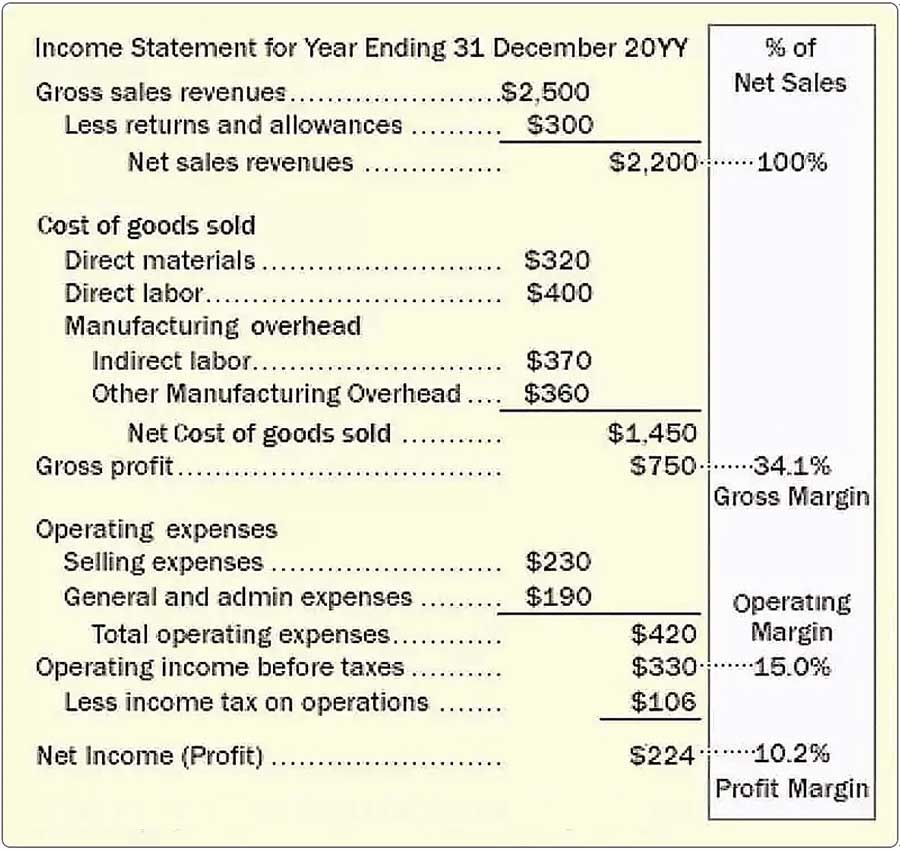

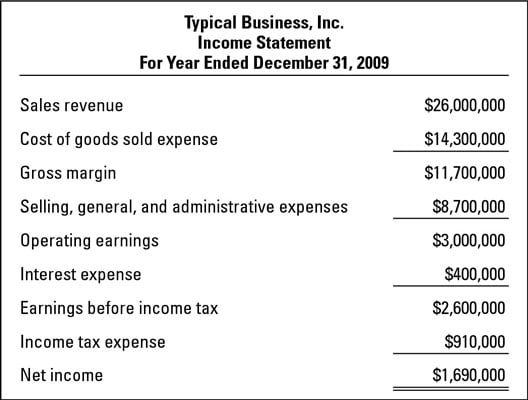

To utilize this method of determining net income you must show the sum of your revenues gains and expenses and losses separately. At the end of the income statement is net.

What Is Net Profit Definition And Examples Market Business News

Net income is the profit a company has earned for a period while cash flow from operating activities measures in part the cash going in and out during a companys day-to-day operations.

Net income meaning for dummies. Ordinary income is income that is not a capital gain dividend or other income subject to special taxation. As you make payments some may come from principal and some from income depending on what you as trustee decide. It provides an overview of revenues and expenses including taxes and interest.

Net Income Net Income Net Income is a key line item not only in the income statement but in all three core financial statements. Heres how an income statement is. Adjusted net income is total taxable income before any Personal Allowances and less certain tax reliefs for example.

Its the amount of money you have left over to pay shareholders invest in new projects or equipment pay off debts or save for future use. Net income is the amount of money thats left after taxes and certain deductions are made from gross income. Then the income over 7550 but below 30650 was taxed at 15.

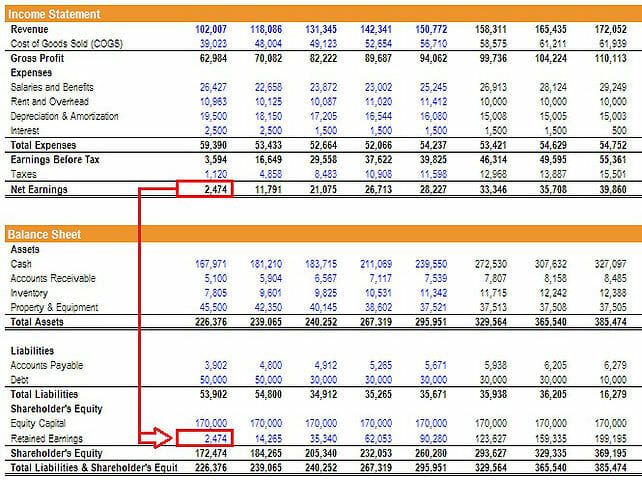

This is the amount that flows into retained earnings on the balance sheet after deductions for any dividends. For example in 2006 the first 7550 of ordinary income reported by a single person was taxed at 10. Net income can also be called net profit the bottom line and net earnings.

This is how much money your company brought in for the period of time your income report covers. You calculate net income for a company by starting with revenue then subtracting all expenses. Others such as beneficiary payments come only from the income.

Net income is the money that you actually have available to spend. One of the most important financial statements is the income statement. The amount of net premiums written sheds light on how much business an insurance company is doing in a specified period.

For example on December 31 2020 Company ABC decided to create its income statement. In other words net income includes all of the costs and expenses that a company incurred which are subtracted from. In the United States income is taxed progressively meaning that there are a series of brackets in which income is taxed.

Net income is synonymous with a companys profit for the accounting period. Its simply your income minus your income tax and other deductions-- the money left over more or less when you receive your paycheck. When calculating net premiums an insurance company must account for the.

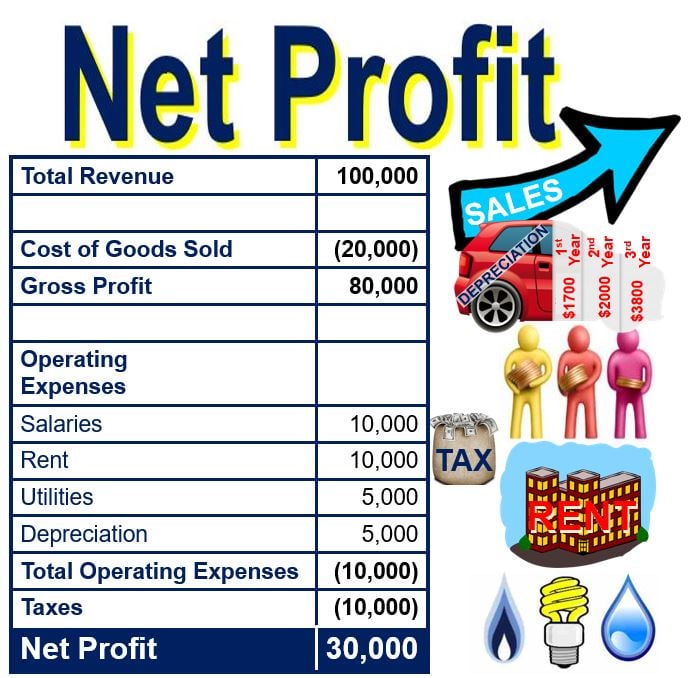

These expenses include depreciation interest taxes and every other miscellaneous spending. Net Income aka Net Sales or the bottom line Subtract the cost of interest payments and income tax from your operating income and you get the bottom line. This example financial report is designed for you to read from the top line sales revenue and proceed down to the bottom line net income.

Trading losses donations made to charities through Gift Aid -. Net income is your companys total profits after deducting all business expenses. While it is arrived at through is calculated by deducting income taxes from pre-tax income.

It is equal to your total income minus tax payments and pretax contributions. The principal is all the property thats available to produce ordinary income like dividends interest or rents. Each step down the ladder in an income statement involves the deduction of an expense.

It is also called earnings profits or the bottom line. Net income is the money left as profits after subtracting all costs and expenses from revenue. Some people refer to net income as net earnings net profit or the companys bottom line nicknamed from its location at the bottom of the income statement.

The amount that is declared by a company on their income statement is critical in measuring its profitability over a period of time. In case of. Net Income for Businesses Net income for a business represents the income remaining after subtracting the following from a companys total revenue.

Common sources of income include a weekly or monthly paycheck Social Security payments royalties and investment income. Cost of revenue operating expenses interest taxes and others. Net Worth Your net worth is your assets minus your debts.

It had revenue and gains of 500000 and expenses and losses of 90000 for the entire year. In simple terms Net Income is the total revenue a business generates after deducting the running expenses.

Ebit Vs Operating Income What S The Difference

Income Statement Example Template Format How To Use Explanation

How Do The Income Statement And Balance Sheet Differ

Margins Measure Business Profitability And Reveal Leverage

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

Gross Profit Vs Net Income What S The Difference

Https Marketbusinessnews Com Wp Content Uploads 2016 06 Net Profit Jpg

Sales Cost Of Goods Sold And Gross Profit Cost Of Goods Sold Cost Of Goods Cost Accounting

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

How Do Net Income And Operating Cash Flow Differ

How Do Net Income And Operating Cash Flow Differ

How Do Earnings And Revenue Differ

How Do Earnings And Revenue Differ

How Do Earnings And Revenue Differ

Net Income The Profit Of A Business After Deducting Expenses

Operating Income Vs Gross Profit

How To Read An Income Statement Dummies

How Do Operating Income And Revenue Differ

Net Income The Profit Of A Business After Deducting Expenses

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Net Income Meaning For Dummies"