Ca Salary Paycheck Calculator

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Free Online Paycheck Calculator Calculate Take Home Pay 2021

California State Controllers Office.

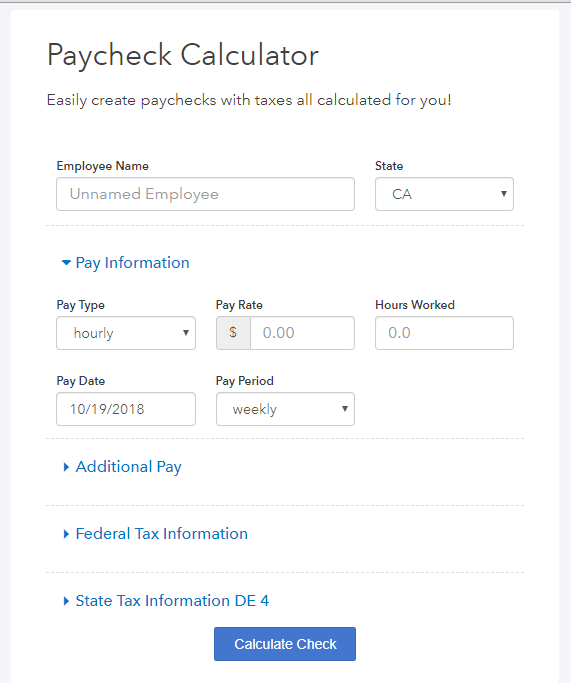

Ca salary paycheck calculator. How are salary paychecks calculated. How to calculate taxes taken out of a paycheck. California Paycheck Calculator Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits. The PaycheckCity salary calculator will do the calculating for you. Free Paycheck Calculator to calculate net amount and payroll taxes from a gross paycheck amount.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. California Hourly Paycheck Calculator. Enter your info to see your take home pay.

This California hourly paycheck calculator is perfect for those who are. If you make 55000 a year living in the region of California USA you will be taxed 12070. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year.

But do you know what is payroll and how is. Your average tax rate is 221 and your marginal tax rate is 349. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

The latest budget information from April 2021 is used to show you exactly what you need to know. Calculate your California net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free California paycheck calculator. Dont want to calculate this by hand.

California Paycheck Calculator Payroll check calculator is updated for payroll year 2021 and new W4. This marginal tax rate means that your immediate additional income will be taxed at this rate. Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more.

Salary Paycheck Calculator Calculate Net Income ADP. Important Note on Calculator. The calculator on this page is provided through the ADP Employer Resource Center and is designed to provide general guidance and estimates.

The State Controllers Office has updated. Why not find your dream salary too. The Internal Revenue Service IRS redesigned the Form W-4 Employees Withholding Certificate to be used starting in 2020.

Hourly rates weekly pay and bonuses are also catered for. Your average tax rate is 220 and your marginal tax rate is 397. Overview of Federal Taxes When your employer calculates your take-home pay they will withhold money for federal and state income taxes and two federal programs.

That means that your net pay will be 42930 per year or 3577 per month. It also issued regulations updating the federal income tax withholding tables and computational procedures in Publication 15-T Federal Income Tax Withholding Methods. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

Social Security and Medicare. Refer to employee withholding certificates and current tax brackets to calculate federal income tax. Overview of California Taxes California has the highest top marginal income tax rate in the country.

Canadian Payroll Calculator the easiest way to calculate your payroll taxes and estimate your after-tax salary. Paycheck Calculator is a great payroll calculation tool that can be used to compare net pay amounts after payroll taxes in different states. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

That means that your net pay will be 40512 per year or 3376 per month. It will calculate net paycheck amount that an employee will receive based on the total pay gross payroll amount and employees W4 filing conditions such us marital status payroll frequency of pay payroll period number of dependents or federal and state exemptions. If you have a job you receive your salary through the monthly bi-weekly or weekly payroll.

Subtract any deductions and payroll taxes from the gross pay to get net pay. This number is the gross pay per pay period. The California Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2021 and California State Income Tax Rates and Thresholds in 2021.

Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes. Can be used by salary earners self-employed or independent contractors.

It should not be relied upon to calculate exact taxes payroll or other financial data. The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

These calculators are not intended to provide tax or legal advice and do not represent any ADP service or solution. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in California.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

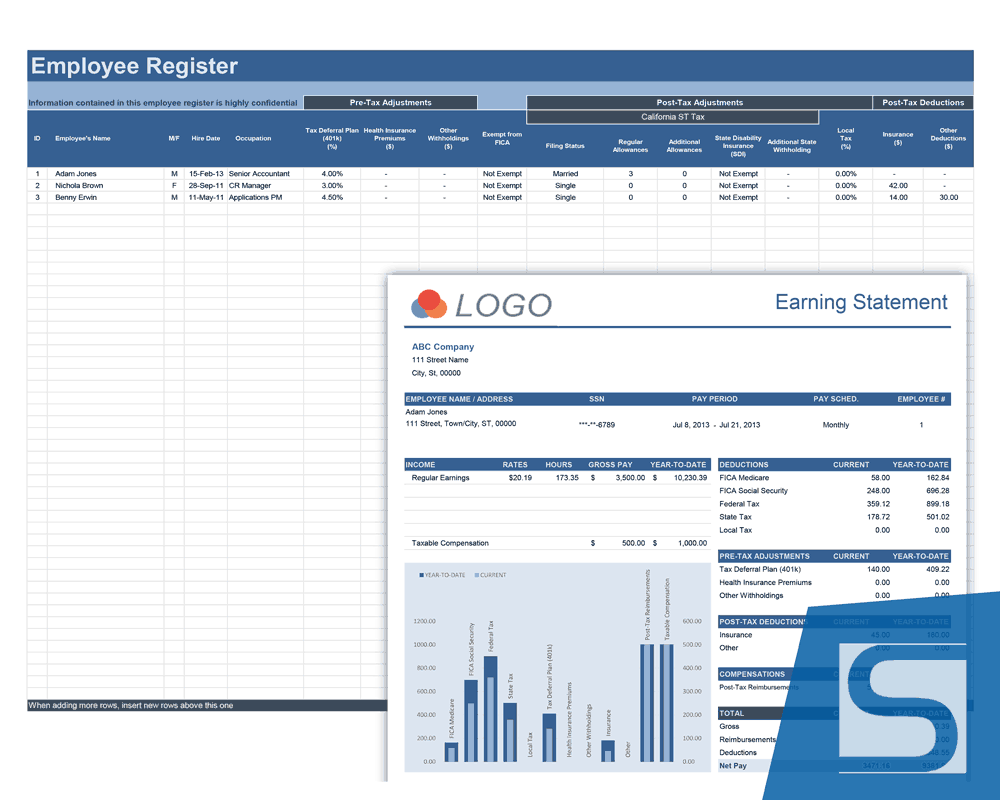

Payroll Calculator Free Employee Payroll Template For Excel

Paycheck Taxes Federal State Local Withholding H R Block

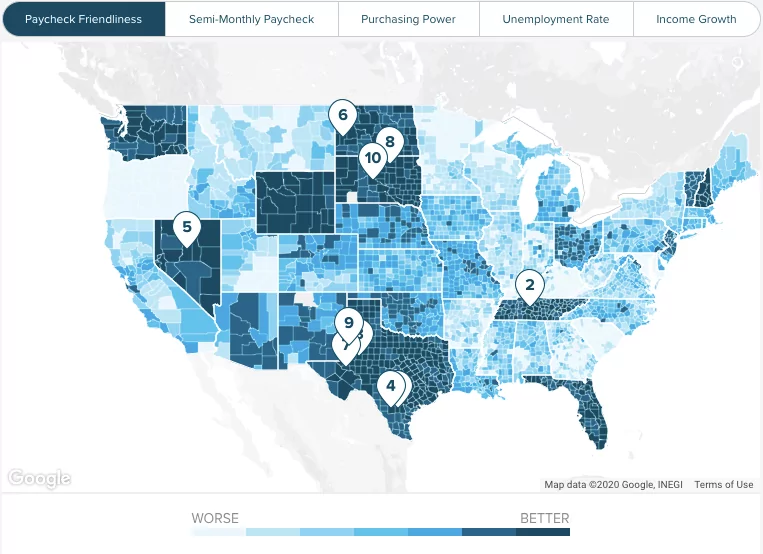

Texas Paycheck Calculator Smartasset

California Paycheck Calculator Smartasset Com Paycheck California Calculator

Top 7 Free Payroll Calculators Timecamp

Gross Pay And Net Pay What S The Difference Paycheckcity

Paycheck Calculator Salaried Employees Primepay

Ca Income Tax Calculator July 2021 Incomeaftertax Com

Salary To Hourly Salary Converter Salary Finance Math Equations

How To Calculate Process Retroactive Pay

California Income Tax Calculator Smartasset Com Income Tax Property Tax Paycheck

Paycheck Calculator Take Home Pay Calculator

Washington Paycheck Calculator Smartasset

New Tax Law Take Home Pay Calculator For 75 000 Salary

Paycheck Calculator Take Home Pay Calculator

2021 Salary Calculator Robert Half

California Overtime Law 2021 Clockify

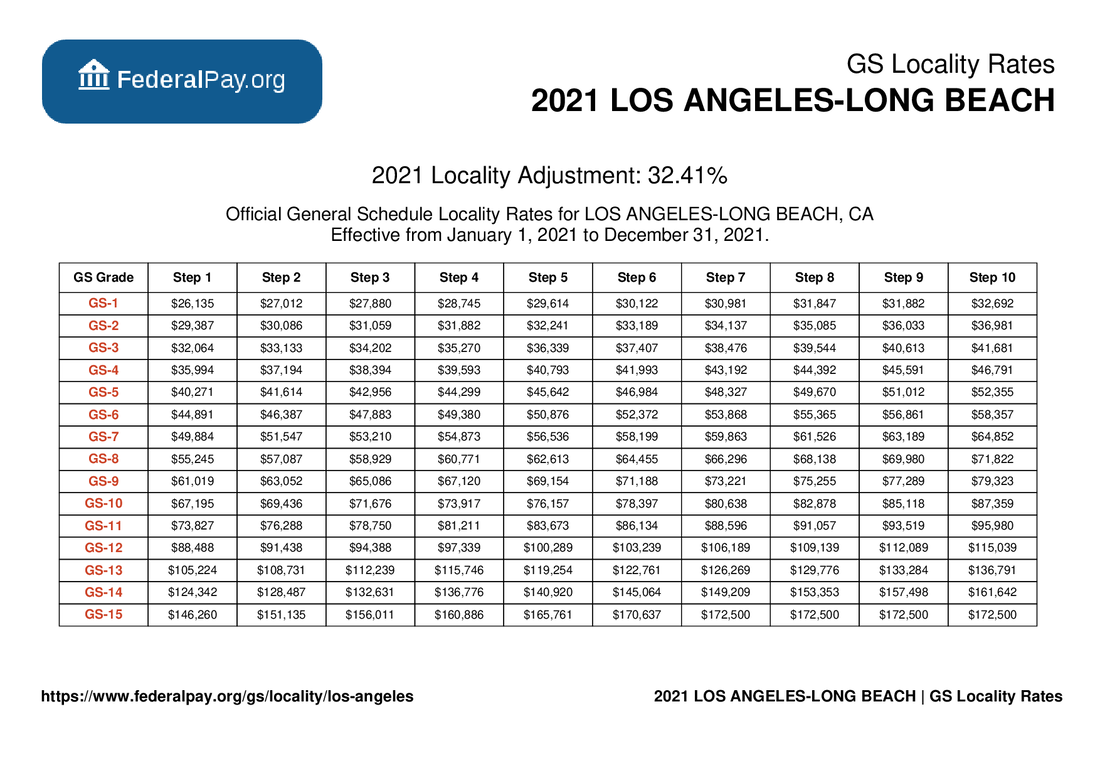

Los Angeles Pay Locality General Schedule Pay Areas

Post a Comment for "Ca Salary Paycheck Calculator"