13th Month Pay Tax Calculator

New Tax Calculator 2018. Find out the benefit of that overtime.

Tax Calculator Compute Your New Income Tax

This calculator is by no means an exact representation of what you will receive.

13th month pay tax calculator. 13 th Month Pay Sample computation Suppose that your basic monthly salary is Php25000 and you have perfect attendance it would be easy to compute how much youre going to get. As mentioned in this article How to Compute your 13th Month Pay there are several factors affecting the calculation such as. You can now provide your salaries from January to December and Thirteenth Month will compute your 13th-month pay.

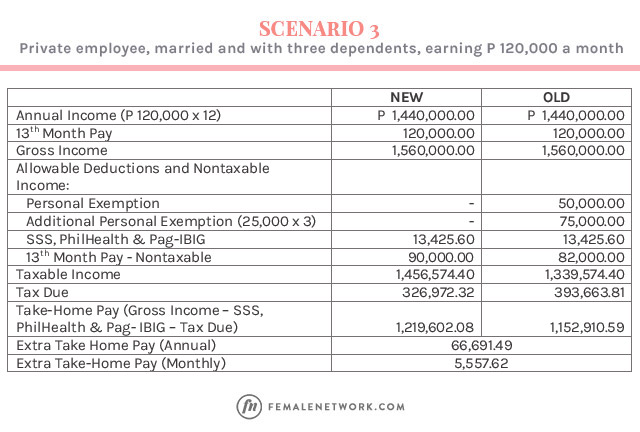

Then since there are 12 months in a year divide the subtracted amount by 12. So one of the things that you must take cognizance of is the tax impact of such payment. Comparing the Republic Act 10963 and Senate Bill 1592 and House Bill 5636 Tax Reform Acceleration and Inclusion TRAIN versus the Tax Rate of 2017.

The 13 th month pay can be calculated as one-twelfth 112 of the basic salary of the employee within one calendar year. Typically each bonus is based on. P25000 x 12 12 P25000 But say you availed of an unpaid indefinite leave.

13th-month payalso sometimes referred to as the 13th-month bonus 13th-month salary or thirteenth salaryis a monetary benefit that is either mandatory by law or customary for the countries that participate. Monthly Other Taxable Income Overtime Commissions etc Monthly Other Nontaxable Income Deminimis. The month in which the statutory end of year bonus is paid is considered as the 13th month.

Alternatively if the employee is paid on a monthly basis the following equation can be used. 120000 90000 12 2500. Our online salary tax calculator is in line with changes announced in the 20212022 Budget Speech.

Every level of employee is entitled to 13th month pay as long as they have worked at least one month during the calendar year. New Tax Calculator using Republic Act 10963 signed December 19 2017. For example for 5.

Read the article to have a complete view of how it is done. Basic pay unpaidpaid leaves absences tardiness. Workers whose basic salary is R10000 or less will not pay income tax on the 13th month pay.

Basic Monthly Salary x Number of Months Worked 12 Taxation of 13th month pay. The amount 14750 is your expected 13th month pay. In some instances depending on the company.

IMPLICATIONS OF THE 13TH MONTH PAY. To put it simpler just get the sum of your basic salary for the calendar year then divide it by twelve. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

To compute your 13th month pay multiply your basic monthly salary to the number of months you have worked for the entire year then divide the result to 12 months. Here is the basic 13th month pay formula in the Philippines. The 13th-month pay is computed based on 112 of the total basic salary of an employee within a calendar year or your basic monthly salary for the whole year divided by 12 months.

It is calculated as 112 of the total basic salary. The 13th month pay is equal to the basic salary and therefore does not include allowances service charge or any other benefits. Ang tax calculator na ito ay pawang para sa mga sumasahod lamang dahil sa ibang sistema ng pababayad ng buwis para sa mga self-employed at propesyunal tulad ng mga doktor.

Apply tax at the rate of 15 on the chargeable income which is arrived at by deducting the amount arrived at in item III above from the amount arrived at in item I above. How to compute 13th month pay. Maaring magbayad ang mga propesyunal na kumukita ng 3 milyon pababa ng 8 na buwis sa lahat ng kabayarang siningil ng propsesyunal sa halip na magbayad ng personal income tax at percentage tax.

Calculate how tax changes will affect your pocket. Menu Thirteenth Month Sweldong Pinoy Android App Contact Us Thirteenth Month by Sweldong Pinoy is a tool for Filipinos in computing their 13th-month pays. Then add the amount to.

Any amount over that set limit is taxable. Depending on the model that is adopted the 13th month is an extra remuneration paid by employers to their employees with the expectation of better commitment and performance. Any negative value is taken as zero.

As stated the tax exemption cap for 13th month pay is fixed at 90000. If your salary exceeds P90000 a month get the taxable amount of your 13th month pay by subtracting P90000 from your salary and dividing the result by 12. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax. But a tax rate of 15 will be applicable for. To calculate your 13th month pay tax subtract 90000 from your monthly salary.

Monthly Basic Salary x Employment Length 12 months. Its so easy to use. Given the formula for the computation 177000 12 14750.

Any company that hires employees internationally is required to comply with the host countrys employment and compensation laws and labor rights. Under the TRAIN Law the 13th month pay worth 90000 and below are exempted from income tax. Enter the number of hours and the rate at which you will get paid.

Compute How Much Taxes Will Be Deducted Monthly Under The Train Law

Everything You Need To Know About 13th Month Pay Sunstar

A Quick Guide To 13th Month Pay 13th Month Pay Months Payroll Software

Dole Guidelines For 13th Month Pay In Private Sectors

How To Compute Your 13th Month Pay 2020 Jobs360

Compute How Much Taxes Will Be Deducted Monthly Under The Train Law

Employees Vs Professionals Which One Pays More Taxes

Dole Guidelines For 13th Month Pay In Private Sectors

Compute How Much Taxes Will Be Deducted Monthly Under The Train Law

How To Compute Your 13th Month Pay 2020 Jobs360

A 13th Month Pay Guide For Employees

Compute How Much Taxes Will Be Deducted Monthly Under The Train Law

10 Things You Should Know About 13th Month

How To Compute 13th Month Pay In The Philippines An Ultimate Guide

10 Things You Should Know About 13th Month

Facts About The 13th Month Pay

13th Month Pay An Employer S Guide To Monetary Benefits

The Basics Of The 13th Month Pay For Employers Elements Global Services

Post a Comment for "13th Month Pay Tax Calculator"