Salary Net Of Tax Meaning

Exemple de salaire brut en net. No results found for this meaning.

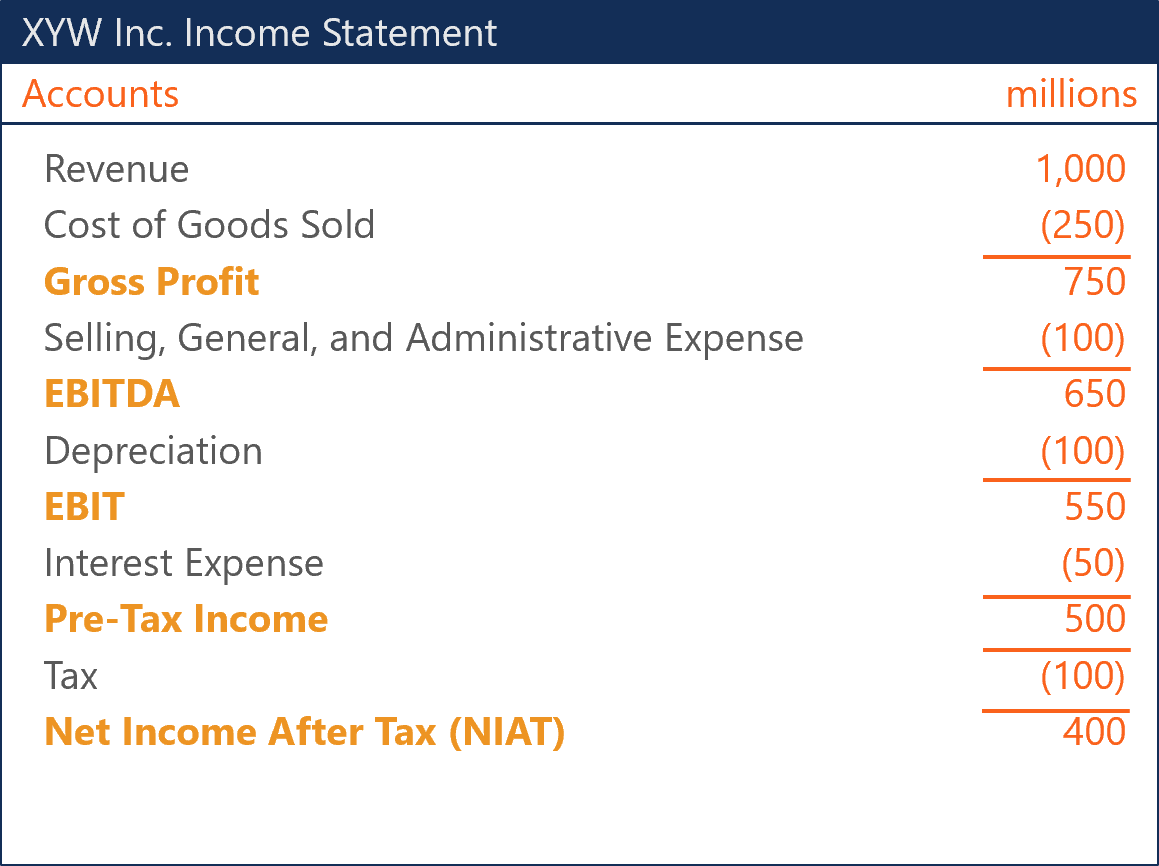

Net Income After Tax Niat Overview How To Calculate Analysis

Bien souvent il va falloir convertir cette somme en net afin de connaître réellement le salaire versé sur votre compte bancaire chaque mois.

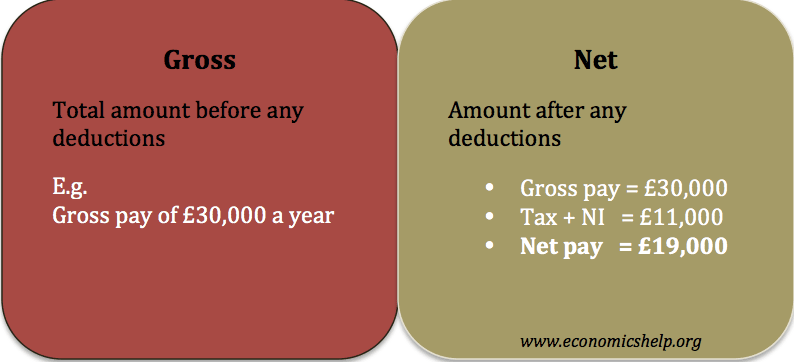

Salary net of tax meaning. Other components of your total. Net salary is the amount that an individual receives after all deductions have been taken out. Gross Salary is the figure derived after totalling all the allowances and benefits but before deducting any tax while net salary is the amount that an employee takes home.

Net pay is the final amount of money that you will receive after all taxes and deductions have been subtracted. Net Salary is the amount of the employees salary after deducting tax provident fund and other such deductions from the gross salary which is generally known as Take home salary. Doù lutilité du calcul salaire net.

It is the base of your pay structure. Although net salary is lower than the gross salary. Net income is the number.

Net salary as defined in Finland for taxation purposes includes all payments from employer to employee during the tax year. Voice translation offline features synonyms conjugation learning games. More features with our free app.

Gross salary Basic salary HRA Other allowances. If the employee has a tax debt or as you suggest other income the employer has to pay his tax. It is a part of your take-home amount.

For an home-based employee allowances such as internet and phone usage will also be added to their basic salary. Gross income refers to an individuals entire income from all sources -- wages self-employment bonuses dividends etc. Income Tax is a progressive tax meaning that individuals with higher wages will be taxed more than individuals with lower wages.

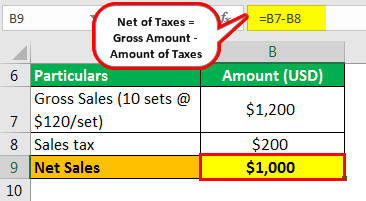

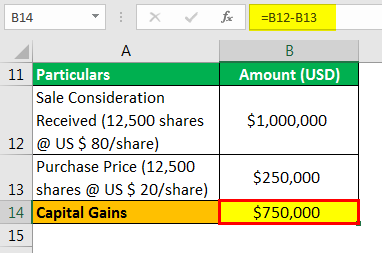

Net of tax is the initial or gross results of a transaction or group of transactions minus the related income taxes. Net pay is the amount thats actually deposited into your bank account or the value of your paycheck. Financial Facts About Singapore.

The term is most commonly associated with the results of an entire business such that its profits or losses are described as being net of tax if the effects of income taxes are calculated into the profits or losses. The average monthly net salary in Singapore SG is around 6 005 SGD with a minimum income of 2 500 SGD. It ranges from 40 to 50 of the total CTC.

Visit irasgovsg for more details. My constituents pay the property tax with a net salary so theyve already paid tax on this too. Net Salary is Income Tax deductions Public Provident Fund and Professional Tax subtracted from gross salary which means Net Salary Gross Salary - Income Tax -.

If on the other hand the employee is due a tax refund the employer gets it. Outil pour convertir le salaire brut net. Gross salary tax deductions and other deductions made when the salary is paid.

Cash salary or cash wages Fringe benefits as valued in tax rules Any retroactive payments including vacation money and corrective payments to equalize employees tax burden in a foreign country. Net salary Gross salary. The information presented here is based on the fiscal regulations in Singapore in 2021.

Salaries in the month in question and for each person. Sur le marché de lemploi la règle veut que les salaires soient exprimés en Brut. The resulting paycheck after the required and voluntary deductions are subtracted is called net pay.

Gross salary is the amount received by an employee without any tax deductions. Either party could lose out on the tax. Only an utter fool would enter into a net salary arrangement.

Because the US tax laws are confusing you might also want to talk with your state Department of Labor andor an employment law attorney when you venture down the road of hiring employees. Your business accounting firm is also another expert in matters relating to payroll taxes.

Salary Paycheck Calculator Take Home Pay Calculator Paycheck Calculator Salary Calculator Salary Paycheck

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Understanding The Difference Between P45 P60 Payslips Online Tax Forms Income Tax National Insurance Number

Net Operating Profit After Tax Nopat Financial Strategies Accounting And Finance Business Quotes

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Net Of Taxes Meaning Formula Calculation With Example

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Net Of Taxes Meaning Formula Calculation With Example

Happy Idioms English Vocabulary Learn English Vocabulary English Language Teaching

The Difference Between Gross And Net Pay Economics Help

Gross Salary Vs Net Salary Top 6 Differences With Infographics

How The 3 Financial Statements Are Linked Together Step By Step Financial Statement Financial Modeling Financial

Net Of Taxes Meaning Formula Calculation With Example

Latest Tds Rates Chart For Fy 2018 19 Ay 2019 20 Tax Deducted At Source Tax Income Tax

Gross Net Salary The Urssaf Converter

Total Comprehensive Income Financial Statements Accounting Income Financial Statement Income Statement

Nopat Vs Net Income Here Are The Top Differences Between Nopat Vs Net Income It S Worth Looking At The Differences Net Income Income Net

How To Calculate Net Income 12 Steps With Pictures Wikihow

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Salary Net Of Tax Meaning"