Mortgage Loan Officer Compensation Plans

This commission is paid every week. Can a mortgage company compensate its Loan Originators such that it pays each Loan Originator 1000 per loan for the 1 st 500 loans arranged and then 700 for each additional loan arranged.

Capital Solid Mortgage Company Html Landing Page Template Mortgage Companies Refinancing Mortgage Home Mortgage

Loan originators may not receive compensation based on the terms of a transaction except for payments based on fixed percentage of the loan amountLoan originators may not receive compensation from both the consumer and another party such as a creditor referred to as dual compensation.

Mortgage loan officer compensation plans. Payee gets credit for the Loan. November 26 2019 159 pm By Ben Lane. From company events through personal support our members are put in a position to succeed with our superlative sales and training tools.

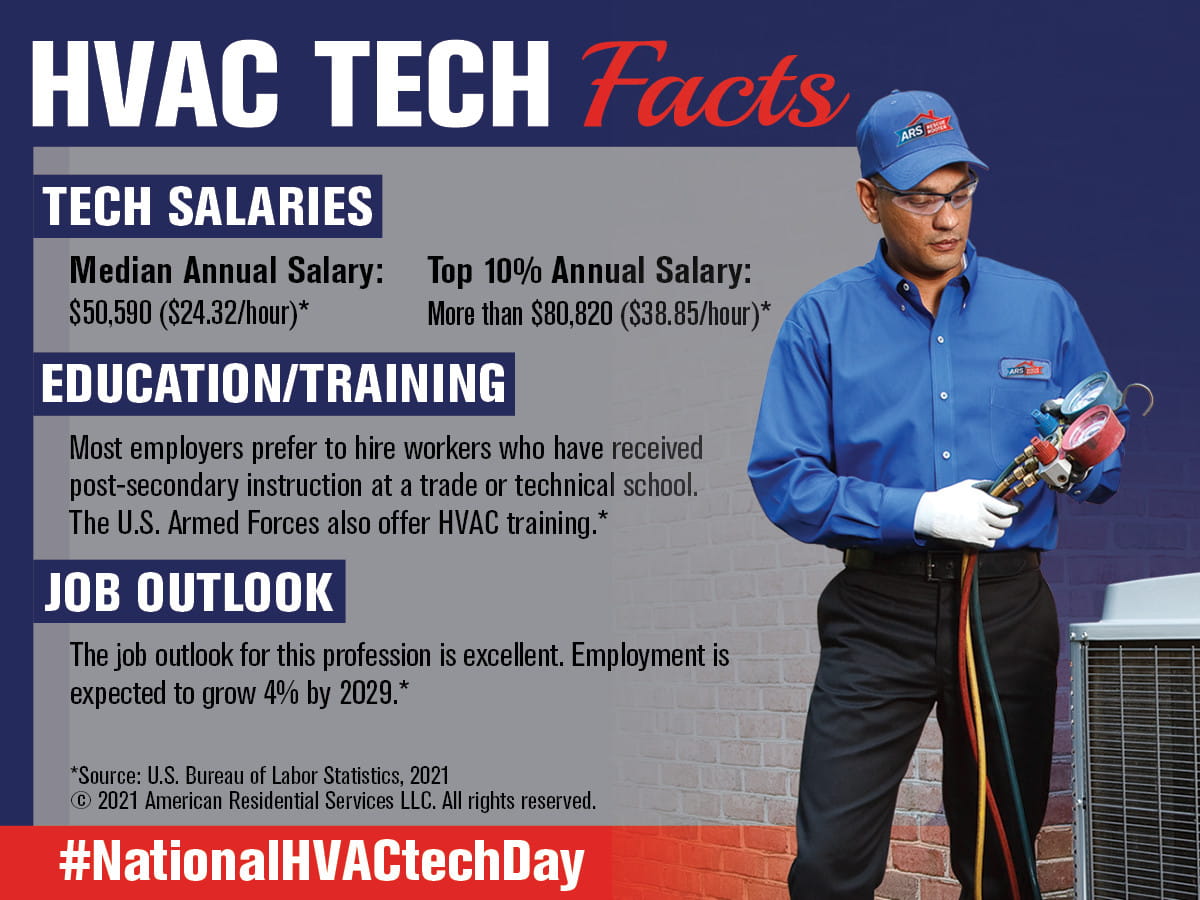

They will pay the loan officer a base salary and a small bonus amount based on the loan amount not the total fees on a file. Qualification and compensation practices The mortgage market crisis focused attention on the critical role that loan officers and mortgage brokers play in the loan origination process. Compensation in the form of a profits-based bonus or similar payment ie based on bank profits from mortgage-related activities to an individual loan originator under a non-deferred compensation plan is excepted from the prohibition against compensation based on loan terms of.

For example compensation includes an annual or periodic bonus as well as any awards of merchandise services tips or similar prizes. Or simply put if a loan officer helps you with your mortgage and your loan amount is 200000 and the loan officer is paid 30 bps the loan officer would make 30 basis points on 200000 or 600. This commission is paid every week.

Any Loan Originations that are due to the Payees primary efforts are eligible for this commission. Payee gets credit for the Loan Income when the origination is funded. The Loan Originator Compensation Rules represent some of the most arcane and risk-fraught pieces of the Dodd-Frank regulation for mortgage companies.

Regulation Z the Fair Labor Standards Act and the Interagency Guidance on Incentive Compensation Plans have all contributed to complicating the employment contract for a mortgage loan officer MLO. The compensation does not in the aggregate exceed 10 percent of the individual loan. At this time the Bureau is not prohibiting payments to and receipt of payments by loan originators when a consumer pays upfront points or fees in the mortgage transaction.

Both of the above methods can create a conflict of interest. Again a payment plan fixed in advance for every loan the Loan Originator arranges for the creditor is an example of permissible compensation. Here are some concepts every financial institution should consider when structuring an MLO employment agreement.

With so many loan officer compensation plans in the market ranging from 500 per closed loan to 300 basis points on closed loan volume how do you know which one is best for you. You have to be competitive enough to retain talented productive originators yet you must also keep your structure in-line with any proxy or element that might cross the line. This incentive pays commissions on Loans originated by the Payee.

Loan originators as the regulations refer to them are not permitted to receive any sort of incentive pay that equals more than 10 percent of their total compensation if that incentive pay is based on any impermissible terms of transactions of mortgage lending. The Consumer Financial Protection Bureau revealed recently that it is considering making changes to the Loan Originator Compensation rule. Our corporate team is committed to your success.

Commissionable transactions are funded originations to customer. Loan Originator LO Compensation. Compensation paid is not based on the terms of that individual loan originators transactions.

Our compensation plan was built to provide both. With Nexa Mortgage you will find the team support and training your need to reach your goals. Any Loan Originations that are due to the Payees primary efforts are eligible for this commission.

Restrictions on compensation for mortgage lenders. Mortgage loan officer compensation agreement. Compensation plan is excepted from the prohibition against compensation based on loan terms of multiple loan originators provided that.

The loan officers usually get compensated in 2 ways. Through commissions taken as a percentage of the total loan amount. Through incentives for meeting specific targets or selling particular financial products.

Defining mortgage compensation plans presents a double edged challenge. Under the rule compensation generally includes salaries commissions fees and any financial or similar incentive your credit union or your loan originator employees receive and retain. Mortgage loan originator compensation plan.

The final rule also establishes tests for when loan originators can be compensated through certain profits-based compensation arrangements. This incentive pays commissions on Loans originated by the Payee. The real challenge lenders face is adapting their compensation plans to.

Commissionable transactions are funded originations to customer. When determining which mortgage company has the best compensation plan for you focus on. Payee is not due any other compensation as part of this agreement.

If you focus solely on which company pays the highest basis points you may be making a big mistake. Because consumers generally take out only a few home loans over the course of their lives they often rely heavily on loan officers and brokers to guide them. Instead the Bureau will first study how points and fees function in the market.

As lenders gear up to attract new loan officers LO many have them are requesting unique or complex compensation plans. But prior to the crisis training and qualification standards for loan. Loan Originator LO Compensation.

Louisville Kentucky Mortgage Lender For Fha Va Khc Usda And Rural Housing Kentucky Mortgage Do S Dont S Befor Mortgage Lenders Buying First Home Mortgage

United Community Bank Picks Lba Ware S Compensafe For Efficient Flexible Automation Of Loan Originator And Processor Commissions Send2press Newswire Mortgage Loans Mortgage Loan Originator Mortgage

Breakthrough Trend Harp M Mortgage Tips Home Mortgage Harp

Firstbank Mortgage Reduces Loan Originator Compensation Processing Time By 75 Percent With Compensafe Send2press Newswire Mortgage Loan Originator Mortgage Loans Mortgage Quotes

Mortgage Free Living Buildmortgagefree Mortgage Cartoon Mortgagelending Mortgageterms Mortgagecal Mortgage Marketing Mortgage Tips Mortgage Humor

Mortgage Commission Software Mortgage Agent Broker Commission Calculator

How I Became A Mortgage Loan Officer Loan Officer Salary Training What It S Really Like Mortgage Loans Mortgage Loan Originator Mortgage Loan Officer

Epingle Par Delcinabethanneemelineqa Sur Mortgage

Https Www Icba Org Docs Default Source Icba Advocacy Documents Summaries Icbasummaryloanoriginator Pdf Sfvrsn 654d9808 4

Loan Officer Commission Split The Ultimate Guide

Http Bhxhbinhduong Gov Vn Diendan Member Php U 109855 Business Planning Business Plan Software Mortgage Brokers

First Time Home Buyers First Time Home Buyers Mortgage Tips Saving Goals

Question To Ask A New Lender Natali Morris Mortgage Marketing Mortgage Loan Officer Mortgage Tips

Grow Your Real Estate Business With A Virtual Assistant Real Estate Assistant Virtual Assistant Real Estate Business

Do S And Don Ts During The Home Loan Process Mortgage Payoff Paying Off Mortgage Faster Mortgage Tips

Letter Of Recommendation For Mortgage Loan Officer Mortgage Loan Officer Mortgage Loans Refinancing Mortgage

How Does A Mortgage Loan Officer Get Paid My Lender Jackie

Lba Ware Issues Q1 2020 Lo Compensation Report Send2press Newswire Mortgage Loan Originator Mortgage Companies Mortgage Loans

What Do Loan Processors Do The Truth About Mortgage

Post a Comment for "Mortgage Loan Officer Compensation Plans"