Total Annual Income Of All Us Taxpayers

All tables are available as Microsoft Excel files. 2020 TPI 19679715147K.

How To Fill Form W2 Tax Forms Accounting Services W2 Forms

In contrast the top 1 percent of all taxpayers taxpayers with AGI of 480804 and above earned 197 percent of all AGI in 2016 and paid 373 percent of all federal income taxes.

Total annual income of all us taxpayers. However people who dont pay federal income taxes must still pay some combination of state income sales and other taxes. In contrast the top 1 percent of all taxpayers taxpayers with AGI of 480804 and above earned 197 percent of all AGI in 2016 and paid 373 percent of all federal income taxes. The other half of earners with incomes less than 43614 took home 116 percent of total nation-wide income a slight increase from 113 percent in 2017 and owed 29 percent of all income taxes in 2018 compared to 31 percent in 2017.

Below is a complete list of tables from various sources and publications which are classified by size of Adjusted Gross Income. Citizens and residents are taxed on worldwide income and allowed a credit for foreign taxes. This group of taxpayers paid 439 billion in taxes or roughly 3 percent of all income taxes in 2016.

Traductions en contexte de total annual income en anglais-français avec Reverso Context. Are you interested in testing our corporate solutions. Neighboring Arizona saw 53476 total filing exemptions come from California.

The tables are grouped into the following categories. Out of a total of 2752 million Brazilian personal income taxpayers the richest 10 percent 275 million taxpayers claimed to earn 364 percent of the countrys accumulated gross taxable income in 2015. Total income taxes paid equaled 16 trillion in individual income taxes.

As illustrated in the graph below in 2019 the richest 1 percent of Americans will collect more than 1 in 5 of income in the United States 209 percent and will pay a slightly higher share of the nations overall federal state and local taxes 241 percent. The two states saw a gross income boost of 34 billion and 22 billion respectively. Partnership and dividend income are taxed at lower rates than normal salaries a policy choice to tax the incomes of business owners at.

Individual Income Tax Returns Filed and Sources of Income. Income subject to tax is determined under tax accounting rules not financial accounting principles and includes almost all income from whatever source. As NTUF reported earlier this year the number of filers with no income.

The top fifty percent of filers earned 88 percent of all income and were responsible for 97 percent of all income taxes paid in 2018. The top 1 percent paid a greater share of individual income taxes 38 5 percent than the bottom 90 percent combined 29 9 percent. Please do not hesitate to contact me.

Most business expenses reduce taxable income though limits apply to a few expenses. A free Excel viewer is available for download if needed. This generally applies to families with a total annual income under 37885.

To be top 1 in 2020 a household needed to earn 531 020 00. Of those 96612233 taxpayers filed individual income tax returns showing 1358 trillion in total income tax due. Individuals are permitted to reduce taxable income by personal allowances.

The 4 trillion US. The statistic shows the US. WASHINGTON Reuters - The US.

This group of taxpayers paid 439 billion in taxes or roughly 3 percent of all income taxes in 2016. Government relies on individual taxpayers. There are approximately 2453 million adults in the Unites States as of that same year.

The annual total personal incomes TPI estimates compiled by the Bureau of Economic Analysis BEA are among the most comprehensive consistent comparable and timely measures of economic activity available statewide and at the national levels. The statistic shows the distribution of tax payers in Brazil based on share of the accumulated taxable gross income in 2015. Total annual income of top 1.

De très nombreux exemples de phrases traduites contenant total annual income before taxes Dictionnaire français-anglais et moteur de recherche de traductions françaises. Governments over 4 trillion annual budget the worlds largest relies heavily on. Personal income increased to about 1968 trillion US.

Understanding The Budget Revenues

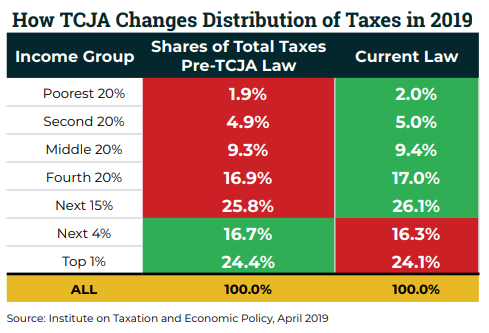

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

Who Pays Taxes In America In 2019 Itep

Form 8880 To Get The Saver S Credit Tax Forms Tax Payment Tax

Deductions On Section 80c 80ccc 80ccd 80d In Income Tax Deduction Income Tax Income

How To Calculate Payroll Taxes All You Need To Know Payroll Taxes Payroll Accounting Services

Sources Of Government Revenue In The United States Tax Foundation

Tax Evasion Among The Rich More Widespread Than Previously Thought The Washington Post

Income Taxes And Small Businesses Income Tax Income Tax Brackets Tax Brackets

This Bar Graph Breaks Down Total Federal Income Tax Revenues By The Earnings Percentiles Of The Americans Who Paid Them Income Federal Income Tax Income Tax

Who Pays U S Income Tax And How Much Pew Research Center

Found On Bing From Www Imoney My Income Tax Tax Deadline Income Tax Return

The Tax Burden Across Varying Income Percentiles Income Adjusted Gross Income Tax

What Is Irs Form 1040 In 2021 Income Tax Return Tax Return Filing Taxes

Taxable Items And Nontaxable Items Chart Income Accounting And Finance Finance

Who Pays U S Income Tax And How Much Pew Research Center

Adding It Up How Much Tax Does A Taxpayer Pay Payroll Taxes Federal Income Tax Tax

Post a Comment for "Total Annual Income Of All Us Taxpayers"