13th Month Pay Is Optional

This guide will explain to you how 13th month pay is offered calculated and taxed so that you can plan for this additional cost of total compensation. For this reason it is not really a Christmas or New Years Bonus which is different and varies by amount or type of gift and is usually optional.

13th Month Pay In The Philippines Obligations For Employers Cloudcfo

What is 13th month pay.

13th month pay is optional. The thirteenth-month pay is a monetary benefit paid to an employee at a specific period s of the year. For Christmas bonuses on the other hand are non-taxable benefit that employers may or may not give to employees. 13th month pay is calculated based on either a single month salary or four weeks salary depending on how compensation and payroll are structured.

The 13th Month Pay is made official and mandatory by PD 851 a decree that was passed by the former and late President Ferdinand E. Marcos signed in 1976. It may be computed pro-rata according to the number of months within a year that the employee has rendered service to the employer.

Your 13th month pay is different from your Christmas bonus. WHAT IS 13TH MONTH PAY. For Christmas bonuses on the other hand are non-taxable fringe.

Therefore the release of the 13th month pay like a Christmas bonus is completely optional. The thirteenth month in most organizations is paid to employees who have successfully completed their probation and whose employment falls within the cut-off date for payment. Thirteenth month pay is a form of compensation in addition to an employees annual 12 month salary.

According to Philippine Law the 13th month pay is one-twelfth 112 of the basic salary of an employee within the calendar year and should be paid in cash ONLY and NOT in kind products airfare other non-monetary rewards. The 13th month pay of a resigned or separatedterminated employee is in proportion to the length of time he or she has worked during the year reckoned a from the time she has starting working during the calendar year or b the time the last 13th month pay was given up to the time of hisher resignation or separationtermination from the service. The 13th month pay is a form of monetary benefit equivalent to the monthly basic compensation received by an employee computed pro-rata according to the number of months within a year that the employee has rendered service to the employer.

It is also known as 13th month salary or 13th salary and in some countries a 14th month salary is also common. The 13th month pay is mandatory by law for all non-managerial staff while the latter is at the discretion of the employer. Sign up today to get started.

It is also optional a contrast to the statutory 13th Month Pay. It was legally introduced in the Philippines in 1975 where it is still enshrined in employment law. Furthermore employers may opt to give it out before during or after December 24.

The 13th month pay is defined as a monetary benefit based of an employees basic salary. The decree states that employers are required to provide their employees a 13th Month Pay before the 24th of December of every year after meeting certain requirements. This is important for employers that are hiring overseas because if the amount is not included in the original salary.

This monetary benefit is a core general labor standard with the Department of Labor and Employment DOLE as the agency responsible to oversee any compromises in fulfilling the mandated payout. The 13th month pay is every employees right and if an employer does not pay is late or does not pay in full this shall be considered improper salary. More confident about hiring a remote worker.

13th month pay is an amount equal to 112 of the annual salary paid by December 24 of each year. It is a mandatory benefit provided to. How to Calculate 13th Month Pay.

Because it is mandatory employers dont have any discretion of whether to pay it or not based on employee performance or. 13th month pay is an additional compensation given to employees in the Philippines typically at the end of a year. The Presidential Decree also states that it should be given to employees not later than December 24 every year.

For instance in Italy the 13th Month.

Managing Employee Benefits Benefitsbenefits Benefit An Indirect Compensation Given To An Employee Or Group Of Employees As A Part Of Organizational Ppt Download

13th Month Pay A Complete Employer S Guide Blueback Global

Why The 13th Month Pay Is Not The Same As The Christmas Bonus Justpayroll

How To Compute 13th Month Pay Sprout Solutions

13th Month Pay Mandatory Benefit In The Philippines

How To Compute 13th Month Pay In The Philippines

How To Calculate Your 13th Month Pay In Philippines 2018 2019 Update

13th Month Pay Vs Christmas Bonus Know The Difference

Rowena Abella Iglesia Having Difficulty Calculating Your 13th Month Pay In The Philippines Here Is An Easy Guide To Help You With Examples Christmas Is Coming It S A Wonderful Time Where

Sir Jp On Twitter The 13th Month Pay Of Marcos Only Applies To Those Employees Who Are Earning P1000 And Below Https T Co Uddubd3lpu Guess Who Removed The Salary Ceiling Requirement And Have

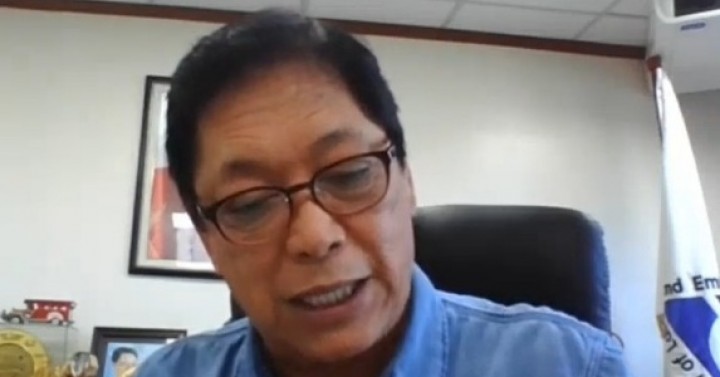

Companies May Delay Grant Of 13th Month Pay This Year Philippine News Agency

Work Hours Jobs And Rates Outsource Accelerator

Labor Laws Governing Cooperatives

A Quick Guide To 13th Month Pay 13th Month Pay Months Payroll Software

How To Compute 13th Month Pay 13th Month Pay Months Computer

Dole Reminds Employers On Giving 13th Month Pay Philippine News Agency

Post a Comment for "13th Month Pay Is Optional"